One of the most colourful characters in the Cannabis industry is none other than Boris Jordan. For those who don’t know who Boris Jordan is. According to Forbes Boris net worth is estimated to be $1.9B. Early on in life, Boris established a successful career as investment banker. Working for likes of Credit-Suisse First Boston heading up its Moscow office until 1995. Today, the Russian American has become to be best known around the world as the King of Cannabis.

The unique opportunity of transitioning existing industries to wholly different regulatory frameworks has been uncharted waters for every cannabis executive, perhaps except for Boris. Privatizing formerly Soviet state-owned entities gave him crucial experience in working with investors, capital markets, and regulatory stakeholders, along with an explicit understanding of just how profitable it is.

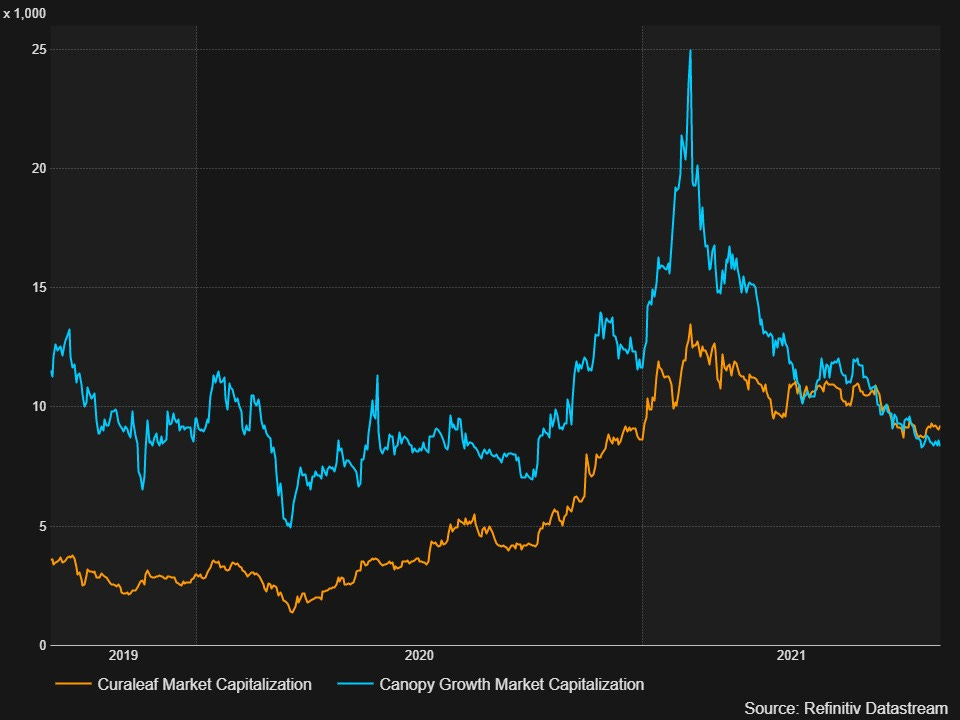

Long ago, I was introduced to Boris Jordan thru a certain hedge fund manager. Overtime, I admired Boris’ aspirations in leading Curaleaf to become the world’s biggest Cannabis company. But at the time, Licensed Producers (LP’s) were all the rage with a Bruce Linton lead Canopy Growth owning the title of: World’s Biggest Cannabis Company. Fast forward to 2021, undoubtedly Curaleaf a Multistate Operator (MSO) is the undisputed world’s biggest cannabis company.

While Curaleaf is far from being my largest MSO holding. There is no denying that Curaleaf remains to be one of the biggest success stories of all the publicly listed MSO’s with Boris at the helm. However, one of my biggest concerns with Curaleaf has been the fact that all the decision-making power lies with Boris Jordan. For that reason alone, I’ve viewed Curaleaf as a one-man army full of foot soldiers and yes men. Some would argue that’s not a bad thing. As some Cannabis companies failed because there was too many cooks in the kitchen sort of speak.

That’s not to say I don’t respect Boris Jordan by any means. When he talks, I listen. Boris is dead on point 90%+ of the time. I also admire how much of an advocate Boris has become for legalization over the years. Championing the cause as if his life depended on it. However, with a Curaleaf proxy vote scheduled for September 9th, 2021. The prospect of legalization in America and Boris Jordan’s power over Curaleaf are set to be forever intertwined.

Boris Jordan has been the face of Curaleaf for as long as I can remember. To the extent that many retail investors I’ve talked tend to believe that Boris Jordan is the CEO. While many others rightfully know him as only being the Chairman. Most investors can’t recall whom the actual CEO of Curaleaf is. That’s not a knock on Curaleaf CEO Joseph Bayern either. It’s just a testament to the staying power of Boris Jordan. However, it is the very same Curaleaf shareholders that are readying to crown Boris Jordan the ‘King of Cannabis Legalization’.

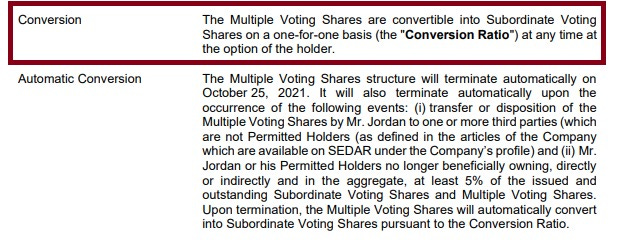

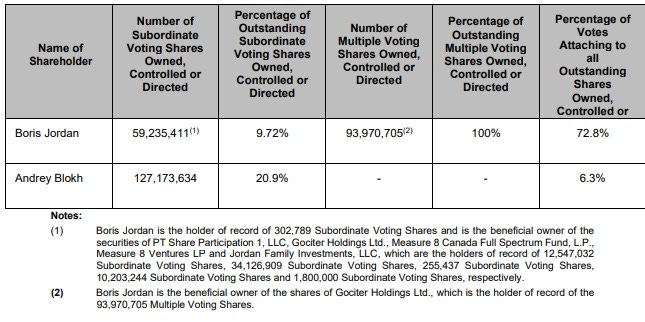

While some of Curaleaf’s retail investors have already given BoJo a superhero persona. There is no denying his reputation precedes him. However, Boris’ powers at be, lie within his 93m+ super voting shares of Curaleaf. Boris has ~72% of the voting rights as of the last MIC, because his multiple voting shares vote at a rate of 15-1. The multiple voting share block as of the last MIC holds 69.2% of the voting power. Even though they vote at 15:1, they only convert at 1:1.

Enter Curaleaf’s ‘Sunset Clause’. Under normal circumstances, Boris would be required to convert his multi-voting shares and abide by the sunset clause. Converting all his multiply voting shares at a 1:1 rate to subordinate voting shares. Boris Jordan’s voting power instantly craters to well below majority control. ~21.76% to be exact. Essentially, Boris would become a king amongst the peasants but without a crown.

The royal persona that Boris Jordan has worked so hard too curate. Has come about by Curaleaf rising to become the kingdom of kings of the PotStocks world. But all will be lost in the end if Boris cannot secure the votes. Maybe it is a title better suited moniker for a queen but that’s another story. Regardless, Curaleaf will likely hold the throne for the foreseeable future. But Boris Jordan cannot postpone the sunset clause singlehandedly by using his multiply voting shares.

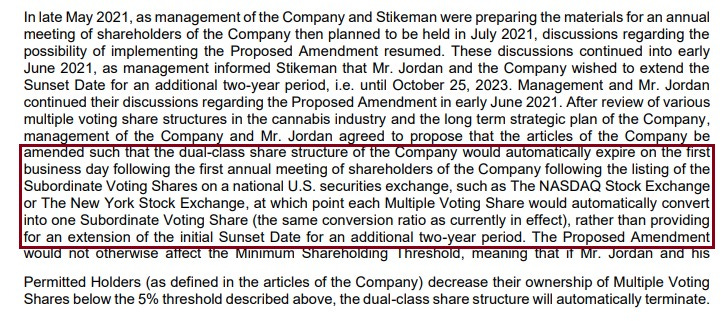

There would need to be proxy vote approval to extend the sunset clause that would maintain his multi voting shares. 2/3rd’s of Curaleaf’s shareholders present at the time of the vote would be needed to vote in favour in order to be Boris’ kingmaker. Which is exactly what the September 9th, 2PM EST meeting is set out to do. Here is a LINK to the live webcast for anyone wanting to watch. However, according to the latest filing there is a catch-22 built into the vote.

The sunset clause will no longer be time dependent as it had been in the past. As Boris Jordan originally sought to extend the sunset clause for another 2 years to October 25th, 2023. But Boris Jordan & Curaleaf management ultimately decided on implementing a milestone clause that would trigger the sunset clause instead of setting a specific date in stone. Which is when Curaleaf stock is listed on the NYSE/Nasdaq creating sunset clause implementation date of sort.

Essentially putting the sunset clause in permanent limbo. While Boris Jordan would argue that the passage of SAFE Banking Act could trigger an eventual up-listing frenzy for MSO’s Graduating from the low volume CSE & OTC. It’s far from a guarantee. What will ultimately trigger a Curaleaf up-listing is federal legalization. A monumental event that Boris Jordan has deemed to be “impossible” to achieve in 2021.

Yet it is an arbitrary event that Boris & Curaleaf is attempting to tether the sunset clause too. Extending Boris’ ‘powers to be’ without a definite time period. As the federal legalization of Cannabis in the USA could never actually materialize for many years’ time if at all. As according to Boris Jordan’s own admission: “You have a president who is adamantly against cannabis, maybe even more so than Trump.”

The implementation of an indefinite time frame that is tied to the formality of legalization and an eventual up-listing is a small cause for concern. If you asked me for my opinion, I would describe this move as very Putin-esque. But, like that of Boris Jordan and Senator Chuck Schumer, I remain hopeful that legalization happens sooner rather than later. However, despite countless tweets from likes of Schumer and Boris on the subject. There remains to be very little action to date.

So, let’s face the music. While Boris Jordan’s & Chuck Schumer’s legacies will live on forever. At 55 & 70 years of age respectfully. With Joe Biden currently in power, followed by a return of a Conservative majority in the house. God forbid but there remains a chance that neither Chuck nor Boris will live long enough to even see legalization come to fruition. While they won’t be memorialized to the extent of a Bob Marley or Willie Nelson. I appreciate Boris’ legalization efforts all the same.

Curaleaf’s implementation of the Sunset Clause will ultimately be seen going forward as an arbitrary event solely decided upon by Boris Jordan. That’s not to say Curaleaf will not up-list to the NYSE/Nasdaq the first chance they get. They’d be stupid not to. While he is no Hadley Ford, one thing Boris is undoubtedly not - is stupid. However, if Boris holds 50%+ of the voting power as Executive Chairman. The decision power for Curaleaf to technically up-list lies solely with Boris Jordan.

While Boris Jordan would argue with the advent of legalization - that his job as Curaleaf dictator is complete. And that he can ride off into the sunset. Absolute power corrupts absolutely. Without getting into too much greater detail then what’s already been disclosed publicly. There are already many signs of this is happening with Curaleaf. As Boris has openly used Curaleaf for self-dealing via his VC fund Measure8 in the past.

One deal seen Measure8 purchase ~11.5% of Cura Select after first investing in the pot company about a year prior. While Measure8 was reported to have just a $120m AUM at the time. The stake was reported to represent about $146 million in Curaleaf stock following the deal’s announcement. Merger discussions supposedly came about when Jordan connected management between the two companies.

At that time Jordan responded: “We demonstrated best practices from an international finance standard, including setting up special committees, outside law firms and requesting three separate fairness opinions.” In the end, Curaleaf paid much less for Cura Select than as anticipated therefore Measure8 stake was reduced overall as well. As Cura Select failed to achieve any of the milestone bonuses agreed upon by achieving a minimum of $130m in a 12-month period (Only ~91.4m achieved). Net loss from the Select division in 2020 was $34.27m. However, the $113m in goodwill associated with the merger has never been subject to a stress test.

The most recent non-arm lengths or related party transaction for Boris and Curaleaf came about for the company’s ~$286m acquisition of Emmac Life Sciences. Which just months prior, saw Measure8 issue Emmac a substantially sized convertible debt. One that equates to 8% equity in Emmac upon conversion. Post-transaction, the former shareholders of EMMAC would have approximately ~3% pro forma ownership of Curaleaf on a fully diluted basis. When all is said and done. Even with $92.7m in goodwill associated with the Emmac transaction. All things considered the amounts may be perceived as drops in the bucket for Curaleaf stakeholders in comparison the companies market cap.

By no means should those amounts be considered chump change. A common thread between Select + EMMAC was that the intangibles goodwill makes up more than 100% of the purchase price as the liabilities they are taking on exceed the value of the tangible assets acquired. While self-dealing is a far to common theme in PotStocks. If it is properly disclosed there remains nothing illegal about it. But without proper checks and balances in place. With absolute voting control, no one is the wiser to question the reasoning for moving forward with an acquisition outside of it considered to be accretive. Despite any notion that independent fairness opinions automatically ensure fair value is paid. The price tag is nothing more than an anomaly.

The beauty is in the eye of the beholder. What remains to be in the best interest of the beholder Boris Jordan may very well be a mutual interest of all Curaleaf investors. As Curaleaf’s stock price, valuation and market cap is a testament to Boris Jordan’s track record. This isn’t an attempt to single out Boris Jordan by any means. While the age old saying of the “rich get richer and the poor get poorer” comes to mind. No one tends to question how the likes of a diamond handed Boris Jordan with all that CURA paper plans to get richer. While I highly doubt that Boris Jordan’s endgame is doing countless related party transaction in the name of self-enrichment. Everyone has an exit plan.

It is important to note that there are countless others in the industry doing the very same thing. To quickly name a few others. The Chairman of TerrAscend, Jason Wild, recently announced a related party transaction of his own. With his VC Fund JW Asset Management owning ~16%+ of Gage Cannabis which largely stems from a $20m USD Reg A+ investment announced late in 2020. Fast forward just 8 months, TerrAscend has announced that they plan to acquire 100% of Gage Cannabis for approximately $545m USD. Then there is interim CEO & Chairman of Haborside Matt Hawkings. Whose sole purpose is to shamelessly vend in assets to Haborside that are directly held in the portfolio of his VC Fund Entourage Capital.

I’d like to clear, that by no means am I advocating for Curaleaf shareholders to vote against the sunset clause extension. All because of the perception that Boris Jordan has made a few rubles from some related party transactions. In BoJo we trust. So, with that said. Are Curaleaf’s shareholders going to be BoJo’s kingmaker? Unlike Tilray’s September 10th Proposal 1 vote. Curaleaf’s proxy vote has a forgone conclusion. Any vote against is basically a throw away vote and I’ll explain why. Russian Andrey Blokh will be Boris Jordan’s kingmaker as he is really the only vote that counts.

Collectively between Boris Jordan & Andrey Blokh ~79% of all the voting power is controlled by the two. With regards to the Sunset Clause vote. Boris is conflicted. So, he needs 2/3 of the subordinate voters at the next meeting to vote in favour of the amendment. While Boris multi-vote shares or subordinate shares don't get to call the shots on this one. Andrey Blokh is entitled to use their common subordinate shares to vote.

Blokh's 127,896,211 shares in that case Boris is conflicted would carry a weight of 23.21% outstanding given that very shareholder attends the meeting. However, shareholder turnout will be relatively low. I suspect that of the ~600m+ shares outstanding less then 250m will be accounted as casting a vote. However, no historical voting numbers have ever been disclosed by Curaleaf. Andrey and other insiders are undoubtedly voting in favour of the extension. Boris has already hypothetically surpassed and achieved the 2/3 threshold needed.

The vote is nothing more than a formality at this point. So, what is Boris Jordan’s real need and justification for extending the sunset clause? I can’t help but think that Boris Jordan is watching the Tilray situation closely. Without a high % of insider voting control and/or a high % of institutional investors. Achieving a majority vote for anything can be extremely challenging. As long as Curaleaf remains on the dreaded CSE & OTC. The institutional holdings of Curaleaf stock at less than 1% will remain to be next to nothing.

What I like most about Boris Jordan is his candidness. From the Criminalization of Cannabis to misinformation about Curaleaf. If he sees something that’s utter bullshit, he doesn’t hesitate to call it out. Without pulling punches. Full Disclosure: Boris has even called out me on occasion. That is what earned my respect. Not the dick measuring stuff about who is the biggest and baddest of them all. Because in today’s investment driven world it’s all about the latest and greatest ROI.

A sentiment that Boris so eloquently illustrated when he was recently questioned about the latest but not the greatest Tilray & MedMen 20% financing deal. In which Boris Jordan subtly replied that he “looked at MedMen 4 times” in doing a massive deep dive due diligence campaign on them. But Boris and Curaleaf ultimately passed on purchasing or financing MedMen every time. As the saying goes: to the victor go the spoils and the losers get MedMen.

So, with my final thought on the issue. I’d like to advocate that no Curaleaf investor should vehemently vote against the sunset clause extension. As it’s evident that BoJo is here for the long haul. He is a vital member of the MSOgang. While Curaleaf may not remain to be the biggest Cannabis company forever. Boris Jordan is currently large and in charge. Even if BoJo has achieved billionaire status and stands to gain financially more than any other investor from federal legalization. Let the King of Cannabis Legalization have his glory. All hail Boris Jordan!