Big Bad Pharma & The Future of Cannabinoids

On February 3rd 2021, investors witnessed the most significant transaction in the Cannabis space since the Canopy Growth and Constellation partnership with Jazz Pharmaceuticals acquiring GW Pharmaceuticals. A UK-based cannabis company, primarily known as the business behind the FDA-approved Epidiolex. The purchase price came in at $7.2B, a whopping 50% premium as Ireland based Jazz Pharmaceuticals has just an $8.5B market cap itself. Therefore it's safe to say that Jazz Pharma is 'all in' on GW Pharma.

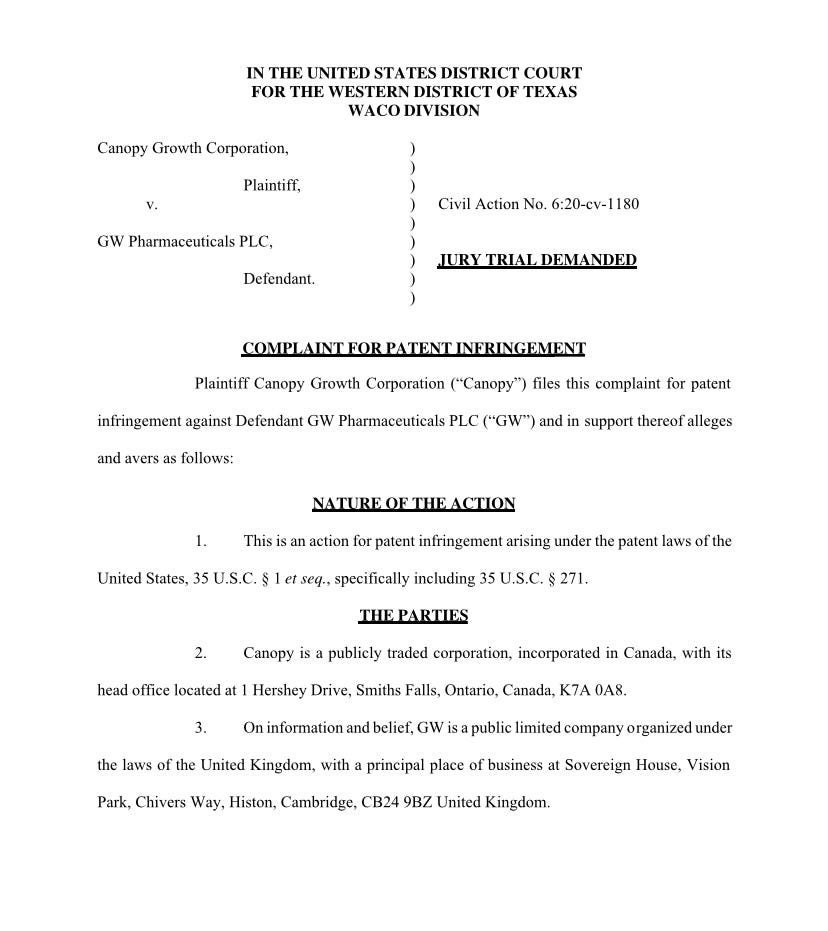

This merger has far-reaching implications within the cannabis sector that most retail investors cannot comprehend. It undoubtedly puts the spotlight back on the future of the drug development of cannabinoids. Bruce Linton was once quoted as saying, "cannabinoids are here for good," but his former company in Canopy Growth filed a federal lawsuit in late 2020 against GW Pharmaceuticals. An effort many investors seen as Canopy Growth grasping at straws. Highlighting the fact that Canopy Growth and is subsidiary C3 are far from the forefront of drug development of cannabinoids compared to any other Licensed Producers. Canopy Growth is attempting to litigate itself into the space.

But that’s not the only lawsuit that GW Pharma is currently facing. Two shareholders of cannabinoid drugmaker GW Pharmaceuticals are suing to stop its planned $7.2 billion acquisition, saying the deal was the result of an unfair and misleading process. The shareholders are primarily accusing GW Pharma & it’s board members for underselling it’s financial forecast. Seen by GW Pharma as a last ditch attempt by two New York investors to exert more value from the deal. However many investors have claimed the contrary for many years that GW Pharma is overvalued when comparing other companies primarily researching cannabinoids.

Aphria backed Tetra Biosciences immediately comes to mind at less than a $100M valuation. An Australian company Incannex with an impressive pipeline of cannabinoid drugs that is GW’s closest comparator is valued at just ~$300m. Teva Pharmaceuticals at ~$44B also has its hand in a cannabinoid project in Israel but it is far from the companies focus. In 2018, another development and distribution deal was signed between Swiss drug giant Novartis and Tilray but the partnership hasn’t amounted to much to date. So far, by a large majority, Big Pharma has primarily watched the cannabis industry from the sidelines, deterred mainly by regulatory concerns. Giving GW Pharma unicorn status. Making it hard to create meaningful basket of comparable’s to that GW Pharma. The global cannabis pharmaceuticals market was valued at only USD $67M in 2019, but the GW Pharma deal is a signal that times are changing.

There is no arguing that geopolitical landscape is changing surrounding Cannabis. As evident by the fact a bill to federally legalize marijuana in USA is being drafted by top senators. What was surprising, is the law will specifically seek to restrict the ability of large alcohol and tobacco companies to overtake the industry. According to Senate Majority Leader Chuck Schumer (D-NY) who said the federal marijuana legalization bill he’s drafting with Sens. Cory Booker (D-NJ) and Ron Wyden (D-OR) will ensure big tobacco and alcohol companies don’t take over the cannabis industry. A lightly veiled shot at the biggest Canadian Cannabis companies that are intrinsically tied to Big Alcohol & Tobacco: Canopy Growth (Constellation Brands), Cronos (Altria), Tilray (InBev), Aphria (Sweetwater Brewing), HEXO (Molson-Coors) & Organigram (British American Tobacco).

What came as a surprise to many. Big Pharma seemingly got a pass from American legislators. Curaleaf’s Chairman Boris Jordan highlighted the complicated relationship that Big Pharma currently has with the Cannabis Industry on his companies latest conference call:

“The real opposition is definitely pharma, pharma right now is very powerful due to COVID. Pharma has still not found the way to manufacture synthetic cannabis. And so they are not necessarily pro-cannabis. And so they're very powerful. They have a huge hold over the FDA. And they're holding back of full legalization at this point in time.”

Big Pharma is more than ready to jump into ‘Medical Marijuana’ face first. However they claim that criminalization of Cannabis of a federal is the biggest barrier to entry. While in fact it’s the biotech’s inability to manufacture biosynthetic Cannabinoids that is holding them back. Legalization of recreational Cannabis is detrimental to Big Pharma’s ability to solely prescribe marijuana. However, Big Pharma is already laid a lot the groundwork over the years. Sanofi at $98B has the second most active trials registered with the FDA involving cannabinoids next to GW Pharma. Furthermore, ~$188B AbbVie has the most patents involving cannabis in the United States.

There are currently ~400 active and completed clinical trials worldwide surrounding just cannabidiol (CBD). Not having a readily available supply of other synthetic cannabinoids has limited the 144+ cannabinoid scope to primarily THC & CBD. In turn, this is hindering further research.

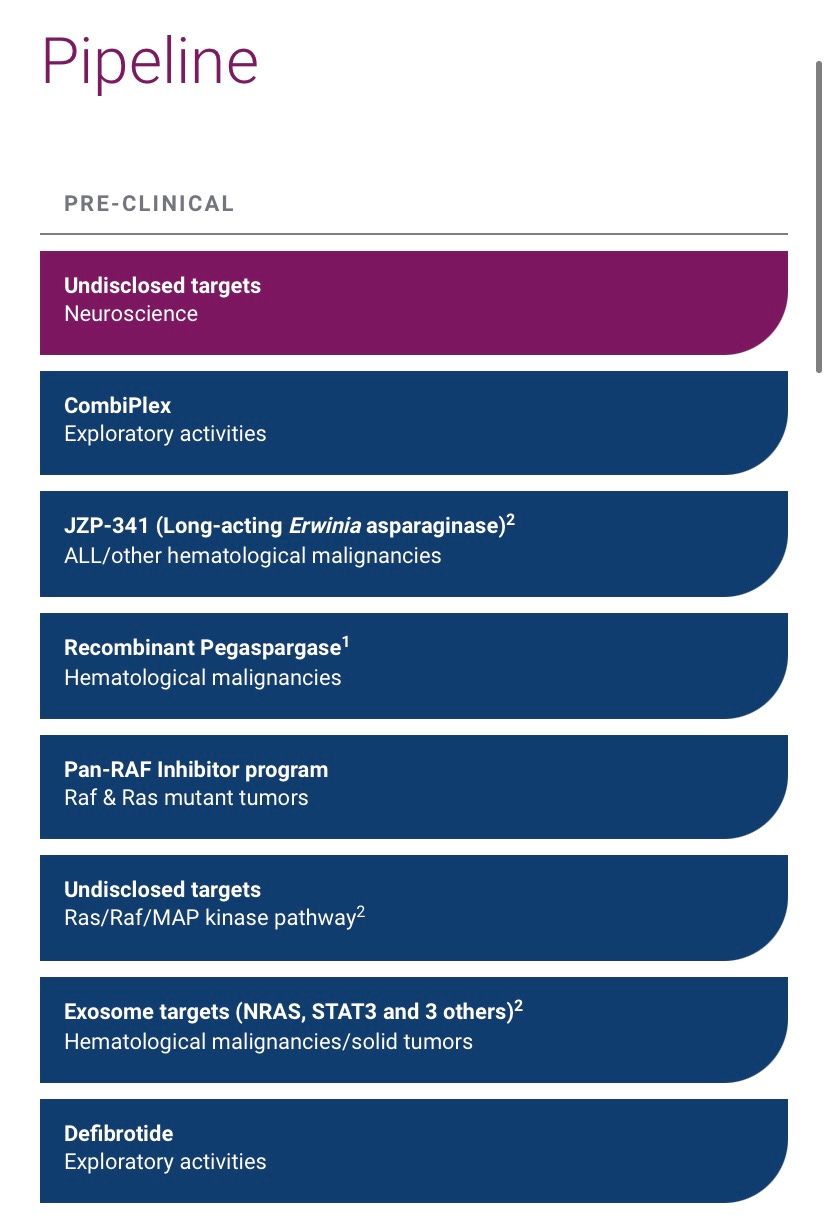

Those seeking to replicate the 'entourage effect' have been limited by the lack of an available cost-effective production of synthetic cannabinoids, despite all GW Pharma's success as a cannabinoid-focused company. Some investors viewed GW as a one-off, a niche player, not giving the entourage of cannabinoids the attention it may have deserved. Jazz Pharma's involvement might be the first sign of things to come. By funding 90% of the $7.2B acquisition with cash, they are clearly bullish on the entire cannabinoid space and are looking to expand GW's drug catalogue and pipeline. Jazz is a more traditional pharma company with a pipeline & portfolio of treatments for cancer and sleep disorders.

This acquisition is very encouraging for further development of the biosynthesis of cannabinoids. It’s a necessity for Big Pharma. In turn, it is very bullish for companies like Willow Bioscience's & Cronos backed Ginkgo Bioworks, who are considered the leaders in this space. I will attempt to explain why, for those who aren't familiar with GW Pharma, they are considered pioneers in cannabinoid drug development. They are the only company globally with an FDA-approved drug based on a metabolite (CBD) derived from the cannabis plant (Epidiolex). Some investors consider them a unicorn. Admittedly, I was never really a bullish believer in GW Pharma pipeline of drugs until early 2020.

There is no denying that Epidiolex is an incredible drug that helps children with rare forms of epilepsy and reduces seizures by ~40%. The bearish thesis has always been that GW launched this drug in 2018 and has a seven-year window to capitalize (own the market), having what is known as an "orphan drug designation." Therefore, to remain profitable long term, GW Pharma needs to expand its cannabinoid-based pipeline. GW Pharma's 'second' most popular cannabinoid-based drug Sativex isn't as popular. However, Sativex is the only drug approved for MS treatments in several countries, approved by the FDA in 2018. Unfortunately, it does not have enough high-quality evidence proving it's effective in general pain management.

Sativex & Epidiolex are composed of active ingredients derived from natural cannabis, leading to greater success rates than synthetic cannabinoids and creating a class of its own. This is evident by the fact that synthetics have been around since 1985, and we haven't yet had any breakthrough results. While still used today, synthetics have little fanfare. First, there was the introduction of synthetic THC - Marinol - which is known as Dronabinol. Johnson Matthey, which produces active pharmaceutical ingredients (API's) for the pharma industry, would later develop a generic form of the drug. Today synthetic THC is primarily marketed by AbbVie, but Marinol/Dronabinol is only responsible for a small fraction of the company's revenue. A very similar synthetic in Cesamet, known as Nabilone, was developed by Eli Lilly in the same year but sold its rights to Valeant in 2004, who then sold it to $22B Viatris.

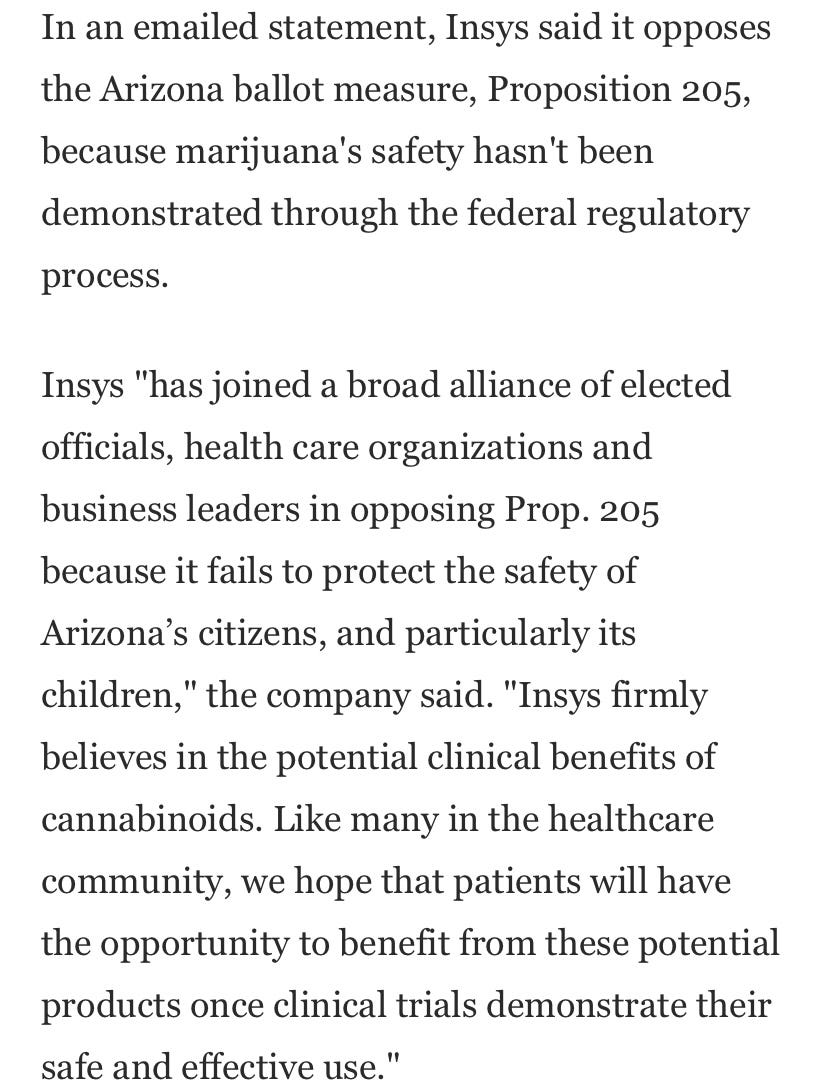

Then Insys Therapeutics spent years developing Syndros, a spray version of Marinol/Dronabinol. The FDA turned down Insys's initial application in 2014, but the company submitted a new form in 2015 and obtained approval in July of 2016. However, Insys are not fans of cannabis because it threatened their opioid dominance, evident by the fact Insys donated $500,000 to help defeat Arizona's Proposition 205, a 2016 effort to legalize recreational drugs. Syndros was derived from the same technology the company developed for its rapid onset fentanyl spray called Subsys. Syndros was seen as an effort by Insys to 'save face.'

Insys was a disgusting company that put it's bottom line before any patient, illustrated by the fact they faked cancer patients to defraud insurance companies. Insys Therapeutics' founder, John Kapoor, was eventually arrested, charged, and found guilty of mail fraud, racketeering, and wire fraud in a Boston federal court and received a 5.5-year prison sentence. Thankfully, Insys Therapeutics filed for Chapter 11 Bankruptcy protection just five days after agreeing to pay $225M to settle the federal government's criminal and civil cases against the company regarding the sublingual fentanyl spray Subsys. However, the death of Insys marked the end of the line for this synthetic spray in Syndros.

Sadly, Insys isn't the only opioid manufacturer in the synthetic cannabinoid arena. Tetra Biopharma, for instance, sourced its synthetic CBD from a company called Rhodes Pharma, directly linked to the Sackler family, who infamously owned Purdue Pharma. Rhodes Pharma's synthetic CBD cannabinoid patent was eventually purchased by Willow Biosciences' joint development partner Noramco. While Noramco was once a unit of Johnson & Johnson until it was acquired in 2016 by the private equity firm SK Capital for a reported $800M. They are also the top supplier of controlled substance API's in the United States. In 2019, Noramco spun its cannabinoids business consisting of about 45 synthetics into a separate company - Purisys. However, Purisys chemical synthesis is ~40% less pure than natural extraction.

Unfortunately, synthetic cannabinoids are still heavily prescribed in jurisdictions that criminalize or heavily regulate cannabis in its natural form. That is why GW Pharma, with its pipeline of other cannabinoid-related drugs they are looking to take to market, is so important. It is also why Jazz Pharma paid such a premium. Synthetics are the equivalent of dinosaurs that just haven't gone extinct yet. Biosynthesis should end synthetics' reign. However, the natural extraction technologies that dominate the field today have their fair share of issues, including high costs and potential contamination issues. Willow Biosciences is at the forefront of this transition with its first-mover advantage and proprietary technology.

Cannabis investors are anxious to understand how biosynthesis companies like Willow Biosciences fit into this fruitful equation. Sativex and Epidiolex are developed from the plant-derived cannabinoids THC & CBD, the two most prevalent cannabinoids found in the plant. Their production is similar to patented extraction methods which resulted in the lawsuit between GW & Canopy Growth. Looking forward, GW's pipeline consists of minor cannabinoids like CBDV and THCV, but these cannabinoids cannot be produced and extracted in commercial amounts from the plant. There are at least 144 different cannabinoids that can be isolated from cannabis, exhibiting varied effects. The potential for biosynthesis is limitless.

GW Pharma and all other biotech companies seeking to tap into the endocannabinoid system will need a manufacturing platform that delivers high purity, consistent, scalable and sustainable cannabinoids. This is exactly what Willow's biosynthetic manufacturing process is attempting to produce in 2021—starting with a Cannabinoid called Cannabigerol or CBG. Most cannabinoids relevant to drug development are minor/rare cannabinoids and need biosynthesis to become commercially available. This applies to GW's flagship drug Epidiolex when generic drugs can come to market 4+ years from now. Even producing CBD via biosynthesis will be cheaper, more scalable and higher purity than the alternatives.

There is little doubt that biosynthesis is the future of cannabinoid manufacturing for drug development. Conventional pharma has typically transitioned away from plant cultivation when it comes to drug development, making it likely that Jazz has a similar view for GW Pharma. However, up until now, there wasn't a choice; all functional cannabinoids needed to come from the plant. While Willow's development pipeline includes CBDV, THCV, CBD, CBGV, THC and others, Cronos & Ginkgo pipeline is currently nil. Much of the hype surrounding cannabis today focuses on Multi-State Operators in the United States. However, Willow Biosciences, with its base of operations in Canada, isn't given the attention it deserves.

Ginkgo Bioworks' Cultured Cannabinoids' ingredients were supposed to offer a more accessible and sustainable way to produce an array of essential products across industries. At the time of its landmark partnership with Cronos Group in 2018, they were expected to produce cultured cannabinoids at high quality and purity but failed to meet expectations. The partnership has seemingly fallen by the wayside. Ginkgo Bioworks is currently focusing on securing a SPAC deal, giving the company the funding it needs to further its research surrounding cultured cannabinoids, alongside a multi-billion dollar valuation. However, Ginkgo has 10+ other business lines, and the lion's share of its revenue comes from producing fragrances.

Willow Biosciences has a significant advantage over all other biosynthesis companies like Crono's backed Ginkgo Bioworks simply because Ginkgo is operating south of the border. Cronos acquired an 84,000 square foot GMP compliant fermentation and manufacturing facility in Winnipeg, Canada, from Apotex Fermentation as part of the deal. A facility they paid ~$38m in 2019 as part of the partnership with Ginkgo. My research has concluded that it has just collected dust ever since. As cannabis/cannabinoids are still federally illegal, it disqualifies Ginkgo from grants and tax credits, putting those operating mainly in the USA at a disadvantage. Willow, however, consistently takes advantage of the Scientific Research & Experimental Development tax credits and grants made available by the Canadian government.

The Jazz/GW transaction is indicative of a fundamental shift in how the world views cannabinoids. Since the 1980's, the endocannabinoid system was viewed as an inaccessible frontier. Now, it is being surveyed by pharmaceutical companies that look forward to exploiting promising targets. This starts with the endocannabinoid system's main components: the two G-protein-coupled receptors (known as cannabinoid receptor 1 (CB1R) and cannabinoid receptor 2 (CB2R)), and their natural ligands anandamide, and 2-arachidonoylglycerol. In the coming decade, the endocannabinoid system's richness will attract many pioneering drug developers that have been stuck on the sidelines.

To that end, I am hopeful cannabinoids will create some riches for investors putting their capital into the biosynthesis and biopharma space. By no means are these types of GW Pharma peer plays to be considered short-term investments. There are no overnight success stories in the cannabinoid space like that of the recreational cannabis space. Raymond James estimates the global market for products made by cannabinoid biosynthesis will grow from CAD $10B in 2025 to CAD $115B in 2040, with an estimated EBITDA coming in at CAD $1.3B and CAD $15.2B, respectively for the sector. A far cry from the USD $67M in estimated sales for 2019. Investing in biotech has always been and always will be a slow roll.

Willow Biosciences is currently the only public peer play with biosynthesis production plans for 2021, in turn, adding revenue to its balance sheet. With a market cap <$200M, it seems like a no-brainer investment in hopes of achieving the coveted first-mover advantage. Willow Biosciences will also get a boost when Ginkgo Bioworks announces a multi-billion dollar SPAC deal in 2021 with a NASDAQ listing. As Willow continues to evolve, I expect the company will likely consider a NASDAQ listing of their own when the time is appropriate. Willow will garner more and more attention from investors and Big Pharma every day that legalization in the USA comes closer to fruition. Over time, Willow also becomes an attractive take-out target as they seem to be the best-situated biotech company out there attempting to manufacture high purity, plant-derived cannabinoids via biosynthesis at a fraction of the cost of cultivation and extraction.

Only time will tell if Willow Biosciences can deliver on all of the promises it has made for 2021. The management team at Willow Biosciences has a good track record of past execution. It remains to be seen if Ginkgo Bioworks (in partnership with Cronos) will ever produce a single 'Cultured Cannabinoid.' However, there remains no doubt in my mind that the most efficient and sustainable approach for cannabinoid-based medicine depends on the future of manufacturing ingredients through biosynthesis. As biosynthesis itself is not something that is cutting edge and experimental in essence. There are many examples in the world that illustrate the benefits of biosynthesis – Insulin, Penicillin, Vanillin, Stevia, and Heme (which provides meat taste to the Impossible Burger), to name a few.

What's there to get excited about when it comes to cannabinoids in 2021? Willow plans to use yeast cells to produce high-value cannabinoid compounds via fermentation in the coming months. As a result, Willow will attempt to produce a compound at a fraction of traditional cost with 99.9% purity in a ten-day cycle on a commercial scale. The company's focus on the biosynthesis of new molecules exposes Willow to large addressable markets, including pharmaceutical applications ranging from inflammation to cardiology, oncology and pain management. These developments will take the Biotech investment space to new heights aside from making the world a better place to live.

Thank you for subscribing and reading my first PotStonks newsletter on Substack. The plan going forward is one bi-weekly newsletter on different cannabis related topics. The topic for the following newsletter will focus on cannabis SPAC's. For other cannabis-related updates, be sure to follow me on Twitter @BettingBruiser